We conducted a survey at Eastside Co about peoples' online reading habits, and what we found came as no surprise: most said they read a lot, yet shuddered at the mere thought of spending more than a few minutes on one article.

Writers, don’t fret! This isn’t a test of your talent, but rather a question of your consumers’ attention span. And that’s no insult to them either. There’s so much distracting content out there these days, packed with insights and vying for attention; why should they dedicate their time to you?

Instead of giving you the most obvious answers like ‘write a catchy headline’ or ‘grab their attention in the intro’, we want to introduce you to a new and increasingly popular way of keeping your readers’ attention: interactive content.

What is interactive content?

Interactive content refers to any type of digital content that requires your reader, viewer or listener to engage actively. It’s a broad definition because it can come in many forms. It can live on any platform, using any form of communication – be it written, auditory or visual.

Think of it as a two-way communication tool that bridges the gap between brand and audience. You should use interactive with one (or all) three of these goals in mind:

- To gain valuable insight

- To deliver something relevant

- To offer a truly unique experience

Today’s consumers are spoilt for choice, but at the same time abused with repetition. We have to give them something different if we want them to give us their time. Make the brief moments you have with your audience count by incorporating interactive content into your strategy from now on. We’ve set out these guidelines to help you understand how you can start doing exactly that.

Different interactivity for different types of content

1 Interactive content for education

Recently we spoke about using content to drive customer engagement, but focused on smaller pieces of writing, weaved together through different parts of the buyer’s journey. Now we’re exploring ways to handle heavier content pieces that are intended to deliver a mass of information at once.

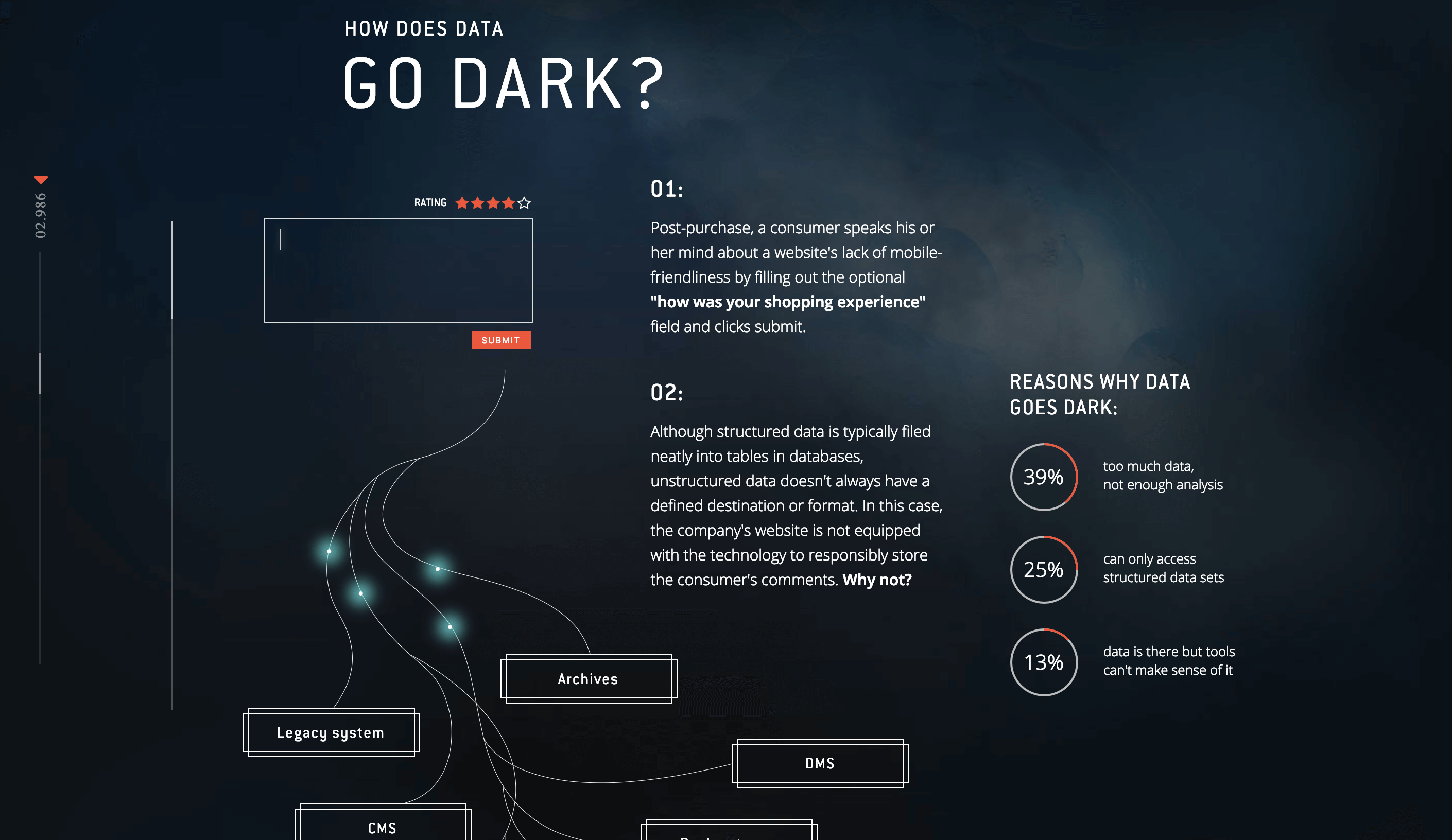

Lucidworks is an enterprise search technology company offering AI-powered solutions. They needed an educational tool that would inform business executives about the depth and importance of data – a topic that is often pre-perceived as dull and complicated. Subsequently, a stunning interactive infographic called The Data That Lies Beneath was created.

This infographic is well worn idea, but remains an aesthetic, informative and compelling display of content creation and interactive design bound together with finesse. And it doesn’t take long to go through at all!

It presents a bulk of numbers and stats in recognisable patterns, flowing from fact to fact seamlessly. When readers are presented with this standard of interactive content, numerous benefits come to life:

- Time spent on page increases significantly as users are enticed to stay and explore

- Share engagement skyrockets, bringing massive traffic to your website

- Relevant back-links are likely to multiply. (We just gave them two right here!)

- Brand recognition is improved, fast-tracking the path to brand recall

- Trust is built and customer loyalty is strengthened

Webinars, podcasts and interviews are another way of implementing effective content for educational purposes. It can be considered interactive because often the audience is invited to join the conversation in one way or another. Even if the audience isn’t contributing directly, the host can be seen as the voice that’s interacting with the brand on behalf of the wider audience.

Look around for podcasts that cover your industry’s topics and reach out if you want to take part, or even start your own channel! By doing so you’ll discover more and more opportunities to connect with your audience through human conversation done in real-time. If you put the well-deserved effort into this kind of content, then you as a brand will easily and freely be able to answer important questions and dive into intricate details, all while exploring the thoughts and feelings of listeners. It’s educational both ways around!

Also, these sessions are genuinely fun, for both the speakers and the listeners. Not every content piece you put out there needs to be driven by a robust and rigid marketing plan. If you love what you do, it’s nice just to talk about it too.

You can listen to this episode here.

2 Interactive content for product demonstration

If you’re running an ecommerce store, then this is likely the most important type of interactive content that you need to be addressing right now. Shopify recently announced that in due time its product will natively support video and 3D model assets, making it easier for all Shopify entrepreneurs to provide richer purchase experiences for their customers, who all use different devices. This feature is expected to be released later this year, and will bring a whole new experience to the forefront of online shopping.

We’ve been paying a lot of attention to AR for our ecommerce clients, and we think you should be too. Last month Ben Douglas, our augmented reality expert, wrote an in-depth article on bringing the virtual into reality with augmented reality on Shopify. It explores the full process of bringing a product to life through 3D modelling, and reveals informative tips on perfecting such a technical project. You should definitely check it out!

Implementing AR as interactive content has a unique set of benefits that truly sets it apart from alternative methods:

- It allows shoppers to imagine and experience the product in their immediate environment

- It increases buying confidence by giving a better sense of product size, scale, detail and material. In turn, this minimises conversion obstacles

- It creates a realistic expectation by displaying the product from multiple angles and incorporating light and shadow

- It provides important product specs in a way that’s easy to digest, so buyers can make more informed decisions

3 Interactive content for entertainment

Video marketing has been with us forever, and remains popular to date because it keeps finding new and improved ways to change things up. Normally its success comes from allowing viewers to sit back and take information in easily. But now, with the help of interactive content, it can also draw viewers back into their screens and persuade them to engage with your creation. Its strategy is designed to immerse your audience and keep them entertained for longer – a very tactical way to create connections and build relationships. Viewers can interact with video in different ways:

-

Hotspot-style videos permits users to click on the video to trigger an action. It can be used to help viewers navigate through different parts of the video, allow them to retrieve information that’s relevant to them, or prompt them to visit your website for a good, intended reason.

-

Choose-your-own-adventure-style videos put viewers in the director’s seat by letting them decide the flow and outcome of the content. When viewers can choose what happens next, you’re giving them a desired sense of control and personalising their experience incomparably. This can also provide fascinating insights and metrics into your viewers’ behaviours and choices.

-

Gamification-style videos bring the ultimate dynamism to entertainment and creates a returning audience - let alone an engaging one. One of the most popular ways to gamify a short video is by including some sort of a challenge, like a quiz or a score-based outcome. This also reveals valuable, first-hand information on your consumers’ true thoughts and opinions.

-

Human-centric-style videos use emotion to evoke interaction. Remember, not every single thing you do needs to be measurable. Dancing, laughing, rewinding and replaying are all forms of interaction too, and the feelings and experiences they bring can be worth more than a comment or a click-through. This YouTube ad by Artlist is a good example of human-centric video design – for their target audience at least! The dialogue is concise, the beat is catchy and the content is enticing. This is the kind of video content that can boost word-of-mouth marketing and increase the chance of prospective consumers converting to loyal consumers.

No matter which type of interactive video content you may choose to incorporate, rest assured if it’s done right it will increase social shares, improve brand exposure and attract new and targeted consumers.

4 Interactive content for gaining information

Data is married to every marketing tactic we apply. Without it, our decisions are less informed and we don’t discover as many new things. The bigger your data, the deeper your knowledge. But don’t underestimate the powerful capabilities of smaller data!

Polls and surveys are interactive content methods that have stood the test of time. You’ll always find them across different kinds of digital platforms. From Instagram and Facebook to pop-ups on websites and surveys on emails – entrepreneurs and marketers will continue using them every single day. There are three main reasons behind its popularity, which applies to all business owners – whether you’re running an ecommerce store or not.

-

It can provide data that is small enough for human comprehension. In other words, it reveals important information that helps you make decisions quickly when you have to, because you’re receiving it in a volume and format that’s accessible, informative and actionable.

-

It provides you with first-hand information, directly from your audience. This means that you’re working with relevant thoughts and opinions, rich in irreplaceable insight on the consumer as an individual. Sometimes you need to cut through the noise of the crowd and hear what you need to hear from one person only.

-

It keeps your platform engagement high and your traffic growing. This kind of content doesn’t require a lot of time or attention from readers, so they’re very likely to continue participating in these quick activities you’re putting out there. Make sure you give certain followers the attention they deserve when they show loyalty towards your content – interactive does mean a two-way relationship after all!

Your own ideas

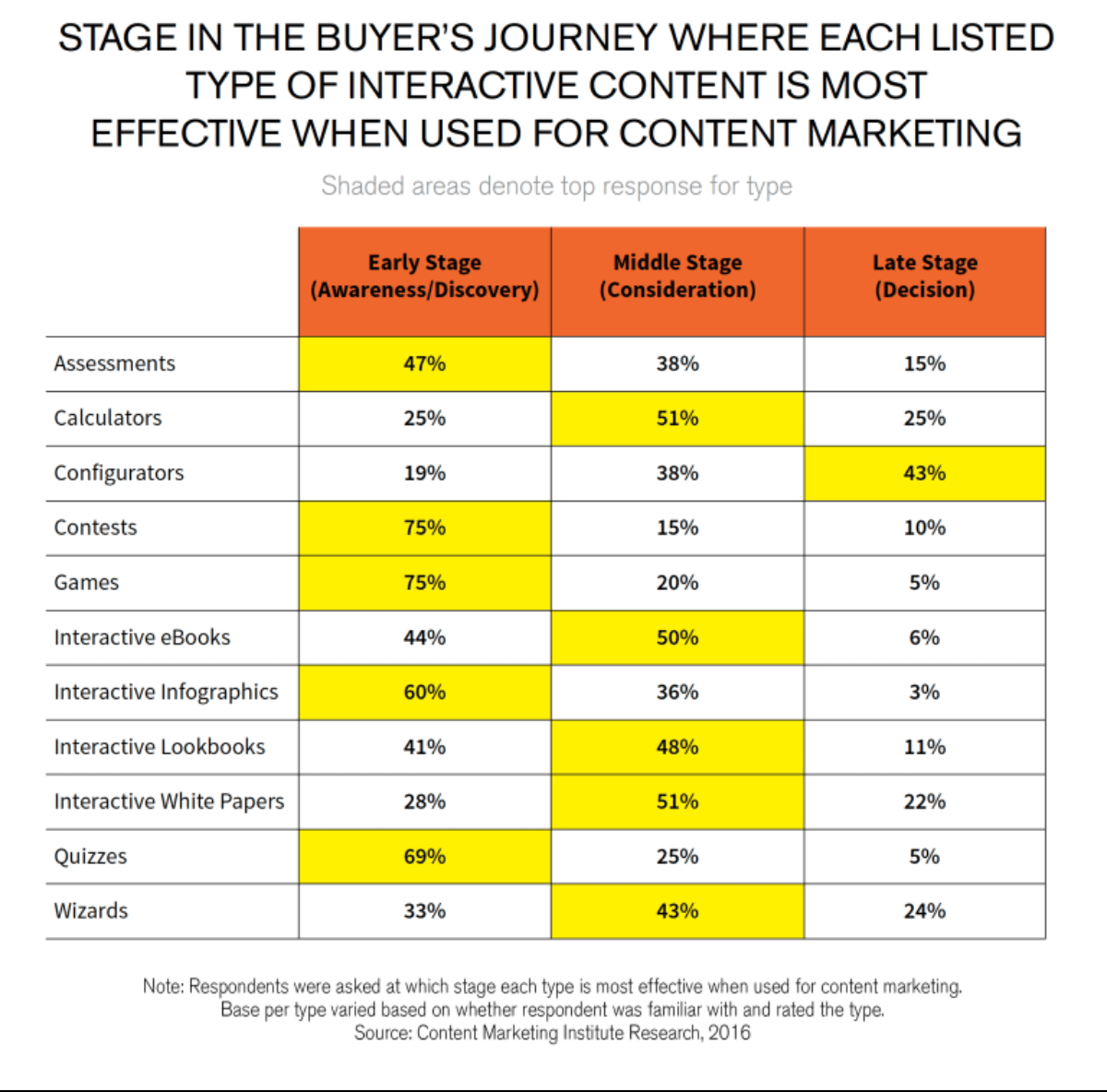

According to the Content Marketing Institute, different types of interactive content are more effective during different stages of the buyer’s journey.

This means you have a lot of creative space to explore, and that you can experiment with multiple methods targeted at various audience segments at different times. If you plan it right and monitor your campaigns carefully, you will eventually find ways to integrate your efforts, and so you’ll soon be building intuitively interactive instances that your audiences will start partaking in out of habit!

If you’ve taken the time to scope through all the tips and tricks we’ve covered here then you’ve probably started thinking of your own creative ideas for leveraging interactive content on your online platforms. In that case, now is the time to reach out to us so that we can help turn inspiration into action! No matter which methods and strategies you’re going to try and test from now on, our content marketing and tech team are ready to see you through every step of the way.